26+ What is borrowing capacity

Borrowing capacity income - expenses x 035. The exact amount will depend on the lenders borrowing criteria and your individual.

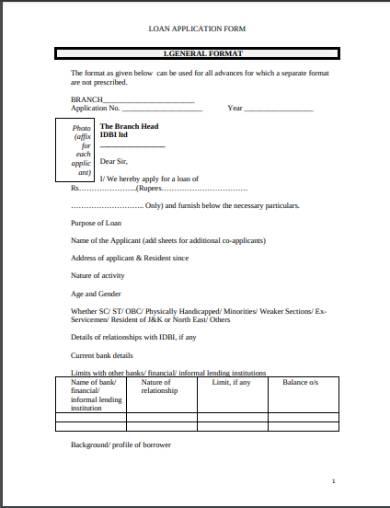

Free 10 Loan Application Review Forms In Pdf Ms Word Rtf

Contrary to what many consumers might think having TOO MUCH credit can also have a negative effect on your borrowing capacity even if you dont use that available credit.

. Your borrowing capacity is the amount a lender will lend you to buy a property. Borrowing capacity is the amount of money a bank or financial institution will extend to you based on your current financial position. Compare home buying options today.

Estimate how much you can borrow for your home loan using our borrowing power calculator. Borrowing Capacity means the ability to obtain draws or advances at the request of a Guarantor or any Affiliate or Subsidiary of a Guarantor in Dollars and within three 3 Business Days of the. Borrowing capacity is the maximum amount of money you can borrow from a loan provider.

Credit history employment history. For example a bank offered you a max 1million dollar loan. Taking them up on their offer of maxing out your borrowing capacity on the other hand is your decision.

Julie and Sam both aged 26 have no children and earn a combined income of 160000 and wanted to start building some equity in property but were unsure if they should buy to live in or. Borrowing capacity is defined by the amount you can obtain from your bank to finance the purchase of your future home. Lenders commonly discuss borrowing capacity with client but that does not mean it is your max or what you would like.

Buying or investing in. Understanding the borrowing capacity is an essential step before making a loan. Youll hear the term borrowing capacity on home loans your car loan.

A households borrowing should not exceed 30-35 of its total income. Lenders will compile your sources of income deduct. View your borrowing capacity and estimated home loan repayments.

Borrowing capacity or creditworthiness is the maximum amount that a company or individual can borrow without jeopardising their financial solvency. Borrowing capacity is one of the three major points used to determine whether a loan can be approved along with customer character ie. It is a main component to determine the type.

Use our borrowing power calculator to get an estimate for how much you can borrow for your home loan in under two minutes. The aggressive rate hikes since May have also bumped repayments on current mortgages by 25 per cent but a surge in fixed-rate loans meant not all borrowers were feeling. Standard borrowing capacity is between.

The borrowing capacity is calculated based on your income current assets your deposit amount existing. 10 hours agoRising interest rates will weigh on property prices and curb borrowing but theres considerable uncertainty about the size and timing of their impact on the housing market a. When you apply for a mortgage lenders calculate how much theyll lend based on both your income and your outgoings so the more youre committed to spend each month the less you.

Your survival depends on it hence the interest of scrutinizing the following paragraphs. To understand our borrowing capacity exactly we need to know. Basically every lenders will.

The borrowing capacity also called debt capacity is the maximum capacity that a company has to borrow from the bank and thus endanger its budget balance. A borrowing base is the amount of money a lender will loan to a company based on the value of the collateral the company pledges. A mortgage broker can find out your max because they have the.

Borrowing capacity is a calculation that indicates the amount of money a lender will offer you to purchase a property. The borrowing base is.

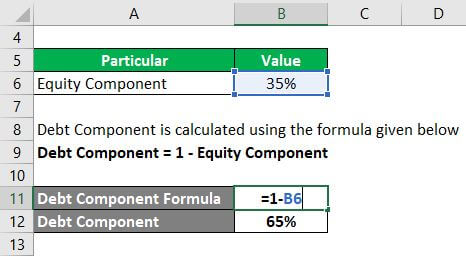

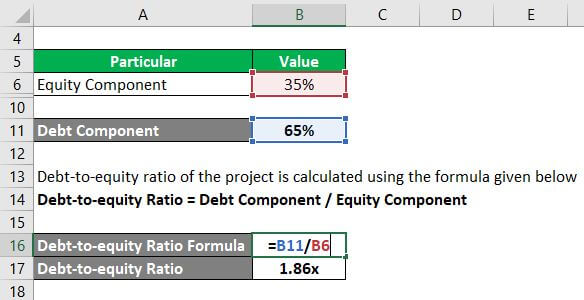

Capital Structure Complete Guide On Capital Structure With Examples

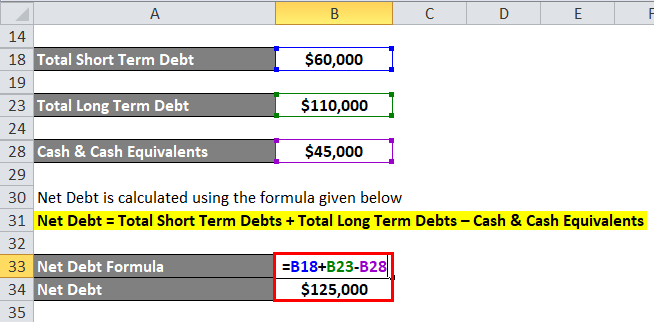

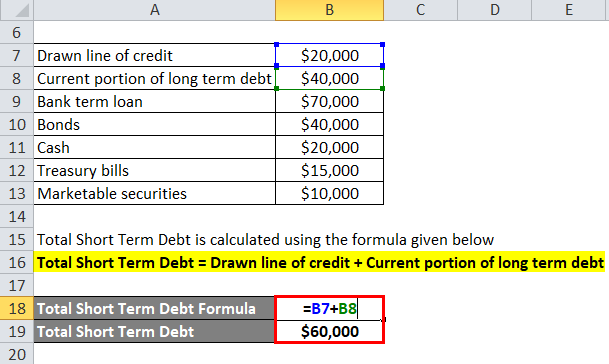

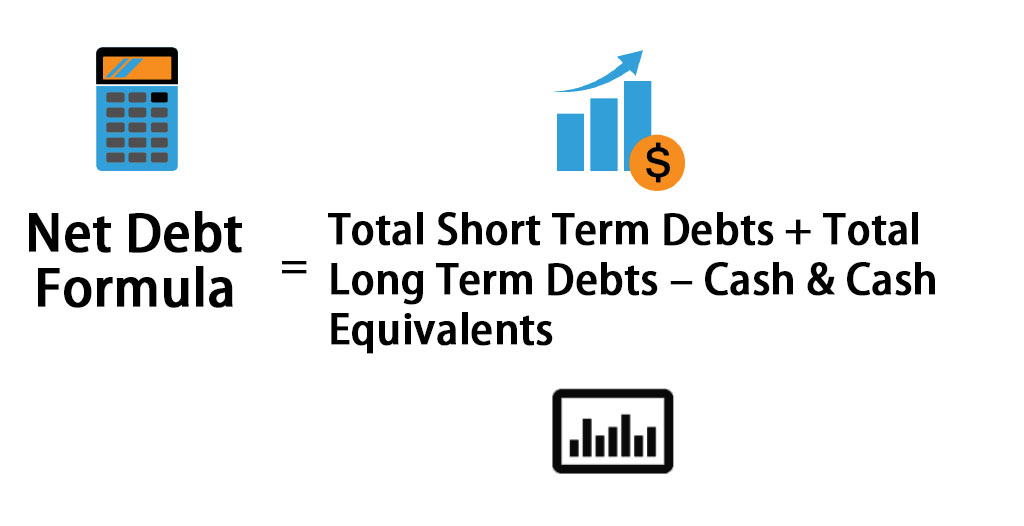

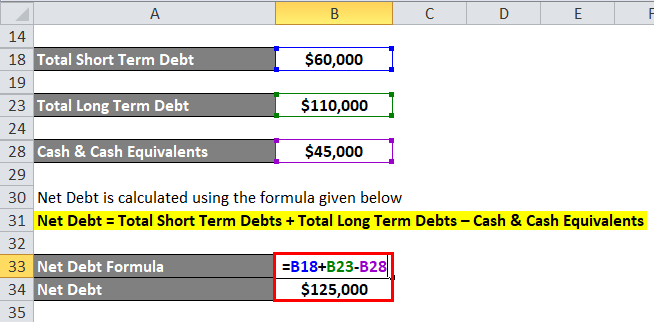

Net Debt Formula Calculator With Excel Template

Effective Annual Rate Formula Calculator Examples Excel Template

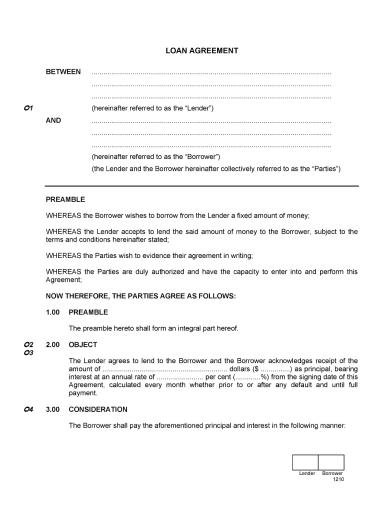

10 Agreement Between Two Parties For Money Examples Format Sample Examples

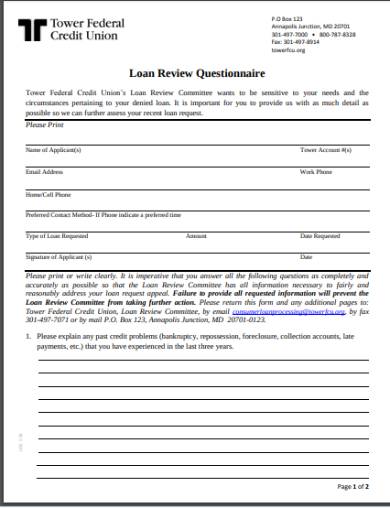

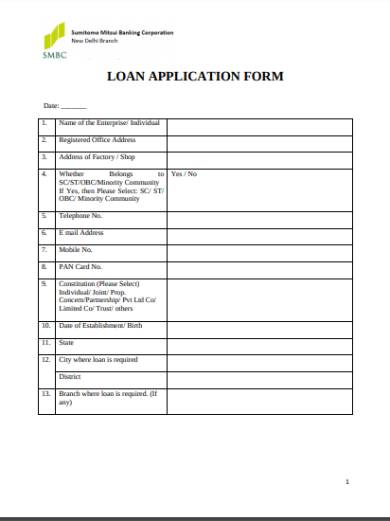

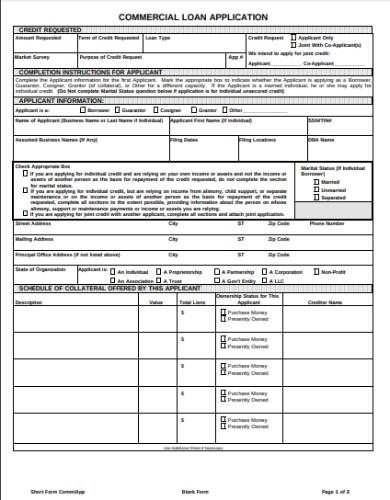

Free 10 Loan Application Review Forms In Pdf Ms Word Rtf

Free 10 Loan Application Review Forms In Pdf Ms Word Rtf

Effective Interest Rate Formula Calculator With Excel Template

Buying A House Here Is The Home Loan Application Process If You Need Help Please Call Mortgage Choice Jody Shadg Loan Application Mortgage Mortgage Lenders

Free 10 Loan Application Review Forms In Pdf Ms Word Rtf

Net Debt Formula Calculator With Excel Template

Free 10 Loan Application Review Forms In Pdf Ms Word Rtf

Capital Structure Complete Guide On Capital Structure With Examples

Free 10 Loan Application Review Forms In Pdf Ms Word Rtf

18 Borrowing Capacity Halinalleyton

Design Leaflet For Golden Eggs Home Loans Postcard Flyer Or Print Contest Sponsored Design Postcard Flyer Winning Flyer Leaflet Custom Postcards

Net Debt Formula Calculator With Excel Template

Free 10 Loan Application Review Forms In Pdf Ms Word Rtf